In the wealth management industry, client experience is everything. Relationships are built on...

Financial advisors today must not only be experts in financial strategies but also in the art of secure, effective communication. In an era of rising cyber threats and increasing regulatory scrutiny, leveraging the right communication tools is critical—not just for efficiency, but for client trust and compliance.

In this post, we explore best practices for email, secure messaging, file sharing, website communication, and video content. We’ll also explain how an integrated platform like SideDrawer can help financial advisors streamline these channels without compromising security.

Some Quick Facts and History

The modern era of email began in 1971 when Ray Tomlinson sent the first networked message, paving the way for decades of innovation in digital communication. What started as a simple method for exchanging messages quickly evolved into a sophisticated system that now underpins much of our online interaction.

From Millions to Billions

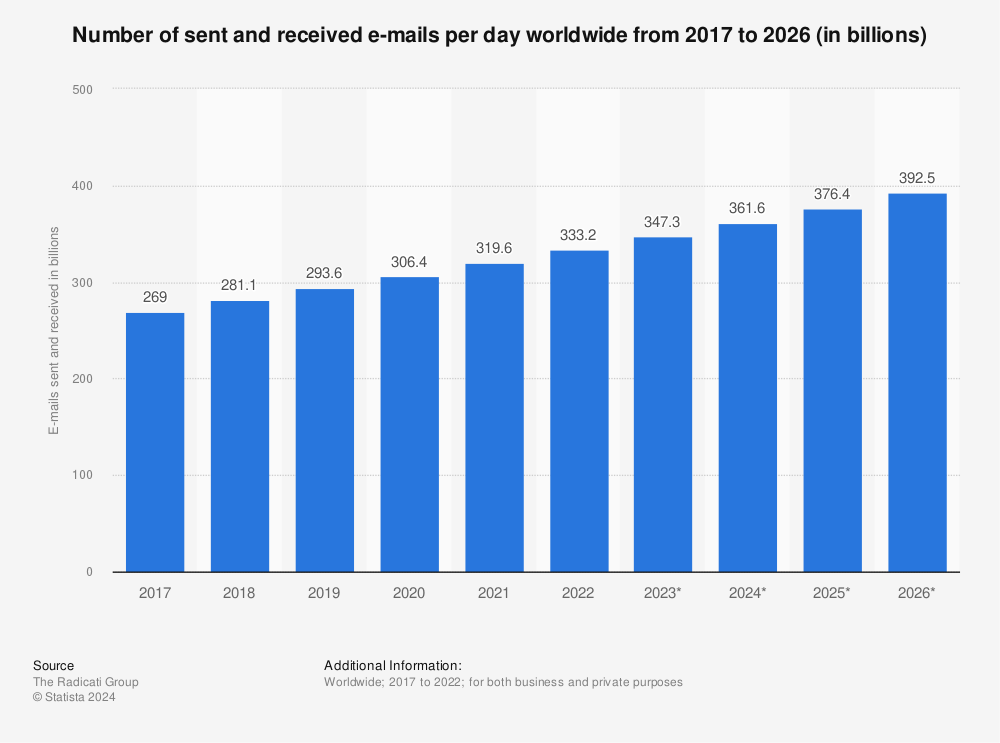

In 1997, there were only about 10 million email users worldwide—a number that seems almost negligible compared to today's figures. Fast forward to 2023, and there are approximately 4.37 billion email users globally. Projections indicate that this number will climb to nearly 4.89 billion by 2027. This exponential growth underscores the enduring appeal and utility of email as a communication medium.

Daily Email Traffic

Today, email remains one of the most heavily trafficked channels on the internet. Studies predict that in 2025 nearly 380 billion emails will be sent daily, reflecting a year-over-year growth of around 14%. With so much activity taking place in the digital inbox, the challenge for marketers and professionals alike is to break through the clutter with messages that are both relevant and engaging.

Use Email For Marketing Your Services

Email marketing is renowned for its impressive return on investment (ROI). Many industry reports highlight that for every dollar spent on email marketing, businesses can expect returns of up to $36. For financial advisors managing tight marketing budgets, email provides a cost-effective way to nurture leads, educate clients, and promote services without incurring high costs.

Secure Email Communication

Email remains an essential tool for formal client correspondence, appointment confirmations, and record‑keeping. It has become a widely used communication tool, but one with significant drawbacks due to productivity issues and security concerns. Traditional email carries inherent vulnerabilities including:

-

Interception and Storage Risks: Even with TLS encryption, emails can be intercepted at multiple points and stored in plaintext on various servers, exposing sensitive client information.

-

Phishing and Spoofing Threats: Cybercriminals exploit email’s lack of inherent authentication to impersonate trusted sources, which can lead to fraud and data breaches.

There are different approaches that people can follow to improve their overall professional productivity as it relates to their use of email as well as general security best practices that can be adopted to more securely use email to communicate. The key for financial advisors to recognize as they move into an increasingly hybrid digital service model is that email is a powerful tool, especially for marketing purposes, but it has significant drawbacks that can impact productivity and threaten business stability if the tool is not used well.

Email Security Best Practices:

-

Use secure email solutions that offer end‑to‑end encryption (e.g., S/MIME or PGP) for confidential correspondences.

-

Implement multi‑factor authentication and regular password updates.

-

Complement email with secure file-sharing links rather than sending sensitive data and documents directly.

-

Consider a dual‑channel approach: share sensitive files via secure services, and communicate passwords or decryption keys through a separate, secure channel such as a secure messaging app.

Encrypted and Monitored Messaging

For real‑time communication, secure messaging apps are critical. Unlike email, these platforms typically offer:

-

End-to-End Encryption: Ensures that messages remain confidential from sender to recipient.

-

Monitoring and Logging: Provides audit trails and compliance records, which are particularly important for financial advisors managing sensitive client data.

-

Enhanced Authentication: Strong, multi‑factor authentication reduces the risk of unauthorized access.

Financial advisors benefit from using secure messaging not only for internal team communication but also for client interactions that require immediate responses without sacrificing privacy.

Secure File Sharing Services

Sharing documents via email is risky. Secure file-sharing services offer a robust alternative by:

-

Encrypting Files in Transit and at Rest: Prevents unauthorized access even if data is intercepted.

-

Granular Access Controls: Allows you to specify who can view, edit, or download files.

-

Audit Trails: Monitors who accessed your documents and when, providing accountability and support for compliance requirements.

By using dedicated secure file-sharing tools, you can ensure that sensitive financial documents, client records, and contracts remain confidential and compliant with industry regulations. An integrated platform like SideDrawer offers these features in one unified solution, enabling you to communicate securely while maintaining comprehensive logs for regulatory compliance.

Websites and Client Portals

Your website is often the first point of contact with potential clients. In coordination with email, a website with information capture pages connected to an effective Customer Relationship Management tool can be a very effective tool for financial advisors looking to market and grow their business.

To operate securely, financial advisors should ensure that their websites:

-

Employ HTTPS: Encrypts data transmitted between the client’s browser and your server.

-

Integrate Secure Client Portals: Allow clients to log in and access sensitive documents, financial reports, and personalized advice in a secure, centralized environment.

-

Feature Updated Privacy Policies: Clearly outline how client data is protected and used, reinforcing trust and compliance.

A well‑designed client portal minimizes the need for insecure email attachments and facilitates smooth, secure communication.

Video Content and Conferencing

Video conferencing and secure video content are increasingly important, particularly as remote consultations become common. These videos, especially when developed with a professional service like HeyAdvisor, can be a powerful way to communicate important information with your clients while also creating the feeling of an individual touch and personal connection.

Ensure that your video platforms:

-

Offer End-to-End Encryption: Protects sensitive financial discussions from eavesdropping.

-

Include Meeting Logging and Recording Options: Helps maintain a record of conversations for compliance and client reference.

-

Support Secure Screen Sharing: Allows you to present sensitive financial data without risking exposure.

Integrating Communication Channels with SideDrawer

To manage these diverse communication needs, financial advisors can benefit from an integrated solution that ties together secure email, messaging, file sharing, website portals, and video conferencing. SideDrawer is designed to be that holistic platform. It provides:

-

A unified interface to manage all communications securely.

-

End-to-end encryption and detailed logging across all channels.

-

Seamless integration with your existing tools and workflows.

-

Simplified compliance reporting, which is invaluable in the financial services industry.

By leveraging SideDrawer, financial advisors can streamline client communications, reduce administrative overhead, and, most importantly, ensure that sensitive client information is always protected.

Summing It All Up

In today’s cyber-threat landscape, no single communication tool is sufficient. Financial advisors must adopt a multifaceted strategy that includes secure email practices, encrypted messaging, secure file sharing, robust websites, and encrypted video conferencing. Integrating these tools through a platform like SideDrawer ensures that every communication channel meets high security standards while remaining efficient and user‑friendly. This comprehensive approach not only protects sensitive data but also reinforces the trust clients place in your professional services.

.png)