In today's digital landscape, accountants handle vast amounts of sensitive financial information,...

In today’s digital landscape, financial services firms face increasing pressure to safeguard sensitive client information against sophisticated cyber threats. SideDrawer’s Digital Vault offers an innovative solution by isolating client data, enhancing encryption, and implementing granular access controls. This approach not only minimizes the attack surface but also ensures compliance with regulations such as PIPEDA, GDPR, and HIPAA, building trust and reinforcing overall cybersecurity.

Isolate Client Data to Reduce the Attack Surface

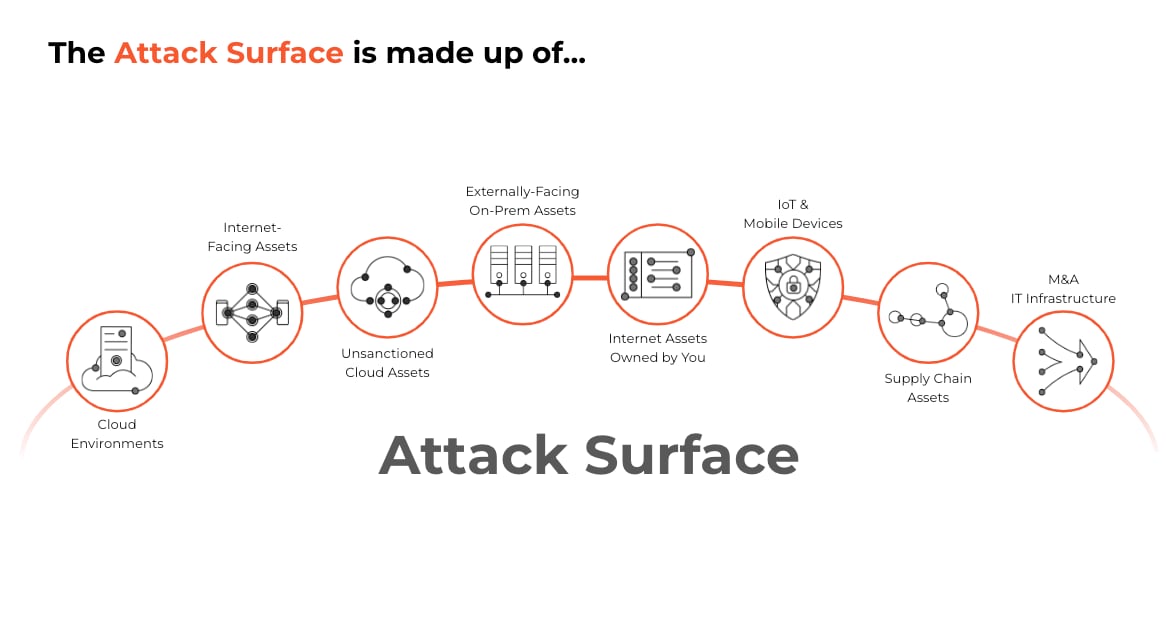

First, it is important to have clear in mind what the potential areas or spaces where a hacker or digital bad actor can target. It it not always enjoyable to get into the mindset of someone looking to steal from your business in order to gain access to wealth, but is it an important exercise. The general principle is that they are either looking to get direct access to financial resources by facilitating or invoking fraudulent financial transactions or they want to cause distributions to your business by either stealing sensitive information or disrupting your business operations until you pay them enough to go away. There is no way to have a digital business presence without creating some exposure and you can learn more about insuring yourself from this risk.

By isolating client data in a dedicated digital vault, SideDrawer effectively helps your team minimize your IT system’s overall attack surface. Instead of a single monolithic database, data is compartmentalized, ensuring that even if one segment is compromised, the breach does not automatically expose the entire dataset. This approach does require that information is effectively and uniquely contained within SideDrawer. This segmentation aligns with best practices advocated by cybersecurity frameworks such as those from NIST and CSO Online, which illustrate that limiting access to isolated segments can significantly reduce potential attack vectors.

IBM Security & Palo Alto Networks

This reduction in exposure is crucial for financial institutions that handle large volumes of sensitive transactions and client records. When your business and your technology teams are ready, there are practices like Zero Trust Architecture that you can adopt once you determine that your digital exposure has grown large enough to warrant a more systematic approach but there are reasonable, lower cost precautions that you can take now to protect yourself.

Ensure Advanced Encryption for Maximum Security

SideDrawer’s Digital Vault employs advanced encryption standards—such as AES-256—to secure client data both at rest and during transmission. Encrypting data at all stages ensures that even if unauthorized access occurs, the information remains unintelligible without the correct decryption keys. This method is supported by guidelines from the National Institute of Standards and Technology (NIST), which recommend robust encryption mechanisms to protect sensitive information. The use of high-grade encryption not only deters cybercriminals but also builds a strong foundation for compliance with global regulatory standards.

Implementing Granular Access Controls

Granular access controls restrict data access to authorized personnel only, based on their roles and responsibilities. By applying the principle of least privilege, SideDrawer ensures that each user has access solely to the data necessary for their role. What this means for you and your business is that access controls should be designed to give only enough information access to each person to complete their job or key responsibilities. Do not grant information access on 'what if' scenarios and focus on making sure that each member of your team only has all of their 'I need' access scenarios addressed. This will minimize the likelihood of insider threats and accidental data exposure.

The OWASP Access Control Project outlines the importance of strict access management, recommending systems that can enforce role-based policies and dynamic permission adjustments. Such measures are essential for maintaining data integrity in environments where multiple users interact with sensitive financial records.

Audit Trails and Version Control for Incident Response

Comprehensive audit trails record every access, modification, and transaction involving client data. These detailed logs enable rapid identification of suspicious activities, facilitate forensic analysis during an incident, and are crucial for regulatory compliance. In the event of a breach, these logs provide a clear timeline and evidence trail, assisting incident response teams in quickly containing and mitigating the impact. This is why SideDrawer has invested in developing the platform from

Version control systems ensure that every change to the data is tracked and stored. This capability is invaluable for reverting to previous, uncompromised versions of data during an incident and for demonstrating a history of compliance during audits. SideDrawer manages a version control system and comprehensive data back-up and recovery practices within the environments we manage and with our Enterprise clients on the installations in their environments to ensure best practices are followed.

Compliance Examples:

-

PIPEDA: The Office of the Privacy Commissioner of Canada highlights the need for secure data management and audit capabilities to ensure accountability.

-

GDPR: The European Union’s GDPR portal mandates robust data protection measures, including detailed logging of data access and changes.

-

HIPAA: The U.S. Department of Health & Human Services requires strict control measures and audit trails for the protection of health information.

These practices not only support compliance with stringent regulatory requirements but also provide stakeholders with verifiable proof of proactive data protection measures.

Building Trust and Enhancing Cybersecurity

The integration of data isolation, advanced encryption, granular access controls, and comprehensive audit mechanisms creates a multi-layered defense strategy that financial services firms can rely on. These measures:

-

Reduce Potential Exposure: By isolating client data, the system confines breaches to limited segments, reducing overall risk.

-

Bolster Data Integrity: Advanced encryption and strict access controls ensure that data remains secure and unaltered.

-

Enhance Incident Response: Detailed audit trails and version control provide the necessary tools for rapid, effective incident response.

-

Strengthen Regulatory Compliance: Meeting the rigorous standards of PIPEDA, GDPR, and HIPAA not only avoids legal repercussions but also signals a commitment to protecting client interests.

Ultimately, these cybersecurity measures build trust among clients and partners, establishing SideDrawer’s Digital Vault as a robust, secure solution for sensitive client data in the financial sector. For further details and data-driven insights, refer to the IBM Security Data Breach Report and NIST Special Publication 800-57.

.png)